Ohio school districts continue to surrender to political pressure at the collective bargaining table, failing to curtail school employees’ lucrative compensation packages. And while this undisciplined spending could manifest itself in the form of reasonable lay-offs or pay-cuts, history demonstrates it to be more likely that Ohioans across the state will soon confront a flurry of school district levy elections, oriented towards raising their property or income taxes.

So long as local taxpayers apply less pressure than public sector unions, this trend will continue. This guide is intended to teach you how to apply much-needed political pressure, and induce fiscal restraint, rather than profligacy, through the ballot box.

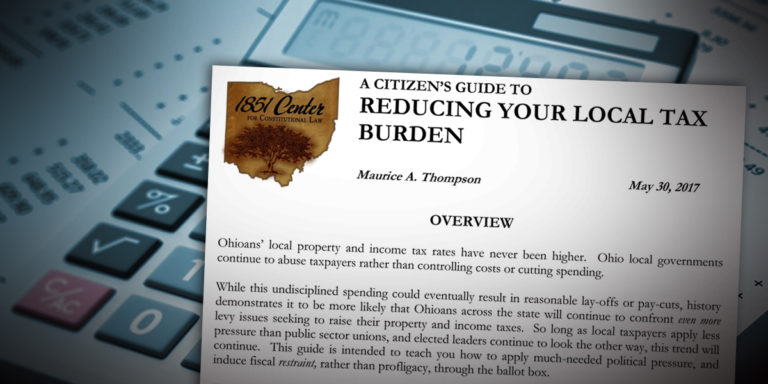

This Guide is a tutorial on how to use heretofore obscure parts of the law, alongside the initiative process, to roll back either a recently-enacted, or even a not-so-recently-enacted school levy tax.

Download the Citizens Guide to Reducing Your School District Tax Burden here.

Download a Petition for Repeal of School District Income Tax here.

Download a Petition for a Levy Decease here.